- Image via Wikipedia

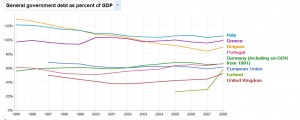

In the past few weeks we have heard a lot of news on uncertainty on Greece’s economic future. The government owes about $400B whilst the country’s GDP is only $339B. So the public debt is 125% of the GDP.

IMF and EU Central banks are now working on a rescue plan that is a tough pill for the country. Majority of the funding for this rescue plan is coming from Germany and senior Germany policy makers want to apply harsh penalties to EU aid recipients like Greece but they really have very little choice but to rescue Greece.

Next in line of European countries in trouble are Portugal and Spain. Portugal with a GDP Of $232B and a public debt that is 75% of its GDP. Spain with a GDP of $1,051B and a public debt that is 43% of its GDP.

So, what does all this have to do with Toronto housing market? Well, in a global market we are all tied at the hip. There is a good possibility the troubled economies will cause a second recession in Europe and that in-turn will impact markets in Far East and N. America.

The financial institutions in Canada have been warning us for sometime now that the current mediocre growth is largely fulled by the public spending and not by an increase in productivity. This is unusual and unsustainable. The interest rates are on the way up and there is a good possibility the housing market will cool off in the next 48 months.